| Summary: What are the five principles of risk assessment and how it contributes to developing a robust risk management system? Here in this article, those fundamental principles are explained in detail on risk identification, risk analysis, risk evaluation, risk control and risk monitoring. |

Risk assessment in the oil and gas industry ensures the safety of operations and mitigates hazards during high-risk activities like drilling, exploration, and refining. This article will explore the 5 principles of risk assessment in the oil and gas industry.

Below are the 5 fundamental principles of risk assessment that form the basis for effective risk management in the industry.

- Risk Identification: Methods like HAZID, FMEA, JSA, PHA, and incident investigations are used to identify risks systematically.

- Risk Analysis: Qualitative and quantitative techniques like bowtie analysis, FTA, ETA, and Monte Carlo simulation assess the likelihood and consequences of risk events.

- Risk Evaluation and Prioritization: Ranking risks based on severity, likelihood, and detectability using a risk assessment matrix.

- Risk Control and Mitigation: Implementing control measures, safety systems, and integrating safety critical elements to reduce or eliminate risks.

- Risk Monitoring and Review: Establishing a risk management system for continuous monitoring and regular review of risk assessments.

By following these principles, companies can proactively manage risks, improve safety, and protect their assets and personnel.

Now, let’s explore each principle in detail.

The 5 Principles of Risk Assessment

#1. Risk Identification

This principle emphasizes the importance of systematically identifying and understanding the risks associated with various activities in the industry.

Several methods and tools are utilized for risk identification in the oil and gas industry:

Hazard Identification Studies (HAZID): HAZID involves a systematic review of the entire value chain of operations to identify potential hazards and their associated risks.

Process Hazard Analysis (PHA): PHA is a systematic approach used to identify potential risks and hazards associated with specific processes. It helps in understanding the critical process parameters, potential failure points, and potential consequences of process-related incidents. PHA techniques include methods like hazard and operability studies (HAZOP), fault tree analysis (FTA), and what-if analysis.

Failure Mode and Effects Analysis (FMEA): FMEA is a method used to analyze the potential failure modes of systems, equipment, or processes, and their associated effects. It helps identify risks associated with equipment failures, human errors, design flaws, and operational shortcomings.

Job Safety Analysis (JSA): JSA, also known as a job hazard analysis, focuses on analyzing specific job tasks to identify potential hazards and risks. It involves breaking down job tasks into individual steps, identifying potential hazards associated with each step, and developing control measures to mitigate those hazards. JSA is particularly useful for identifying risks in routine operational tasks, maintenance activities, and non-routine or one-time tasks.

Incident Investigations: Past incidents and accidents provide valuable insights into potential risks and hazards. Incident investigations involve analyzing historical incidents, near misses, and lessons learned to identify root causes and contributing factors. By understanding the causes and consequences of past incidents, companies can proactively identify and mitigate risks before they lead to severe consequences.

#2. Risk Analysis

Once the risks have been identified, the next step is to analyze and assess them. Risk analysis involves evaluating the likelihood and potential impact of identified risks to determine their significance and prioritize mitigation efforts. This principle aims to provide a deeper understanding of the risks, enabling informed decision-making and effective risk management strategies.

Risk analysis in the oil and gas industry utilises both qualitative and quantitative techniques, depending on the level of detail required and the availability of data.

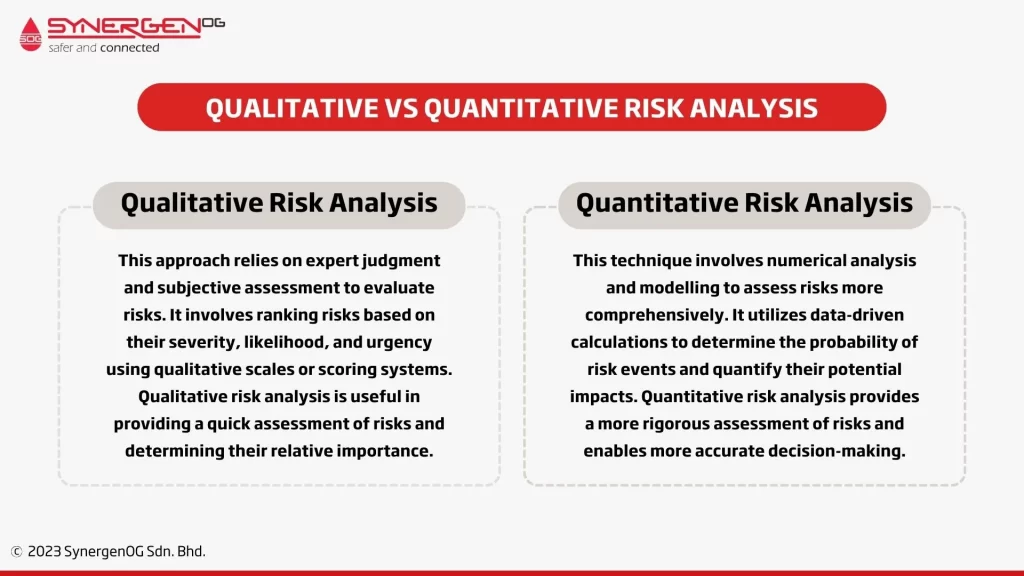

Qualitative Vs Quantitative Risk Analysis

Qualitative Risk Analysis: This approach relies on expert judgment and subjective assessment to evaluate risks. It involves ranking risks based on their severity, likelihood, and urgency using qualitative scales or scoring systems. Qualitative risk analysis is useful in providing a quick assessment of risks and determining their relative importance.

Quantitative Risk Analysis: This technique involves numerical analysis and modelling to assess risks more comprehensively. It utilizes data-driven calculations to determine the probability of risk events and quantify their potential impacts. Quantitative risk analysis provides a more rigorous assessment of risks and enables more accurate decision-making.

Commonly Used Tools & Methodologies in Risk Analysis

1. Bowtie Analysis

This technique visualizes the relationship between potential hazards, underlying causes, and the consequences of a risk event. It helps in understanding the barriers and controls in place to prevent or mitigate the occurrence of a risk event. Bowtie analysis is an effective tool for demonstrating the effectiveness of control measures and identifying any critical gaps.

2. Fault Tree Analysis (FTA)

FTA analyzes the various possible failure events and their causes that could lead to a specific risk event. It uses a graphical representation of a tree-like structure to determine the probability of the top event (the risk event) occurring based on the probabilities of the preceding events. FTA helps identify critical failure paths and prioritize risk mitigation efforts.

3. Event Tree Analysis (ETA)

ETA is used to model and analyze the potential consequences that may result from a risk event. It utilizes a graphical representation of branching events to consider different possible scenarios and outcomes. ETA helps in understanding the potential impacts of a risk event and aids in the development of effective prevention and response strategies.

4. Monte Carlo Simulation

This simulation technique uses statistical sampling to assess the overall risk profile by considering different combinations of input variables and their uncertainties. Monte Carlo simulation helps generate probability distributions for potential outcomes, enabling a more robust and quantitative analysis of risks. It provides insights into the potential range of outcomes and aids in making informed decisions.

#3. Risk Evaluation and Prioritization

This principle emphasizes the importance of determining which risks require immediate attention and resources for effective risk mitigation.

Risk evaluation and prioritization involve the following key steps.

-

Risk Scoring and Ranking

Risk scoring involves assigning scores or values to risks based on their likelihood and potential impact. Scoring criteria may vary depending on the organization’s preferences and objectives, but commonly used criteria include a 1-5 or 1-10 scale.

The likelihood and impact ratings can be multiplied to derive a risk score, providing a quantitative measure of risk. Risks can then be ranked based on their scores to determine their relative importance.

-

Risk Acceptability Criteria

Risk acceptability criteria establish the thresholds or limits within which risks are deemed acceptable or tolerable. These criteria are typically determined based on regulations, industry standards, organizational objectives, and stakeholder expectations.

Criteria can be set for various dimensions, such as human health and safety, environmental impact, reputational damage, and financial implications. Risks that exceed the defined criteria are considered unacceptable and require immediate mitigation actions.

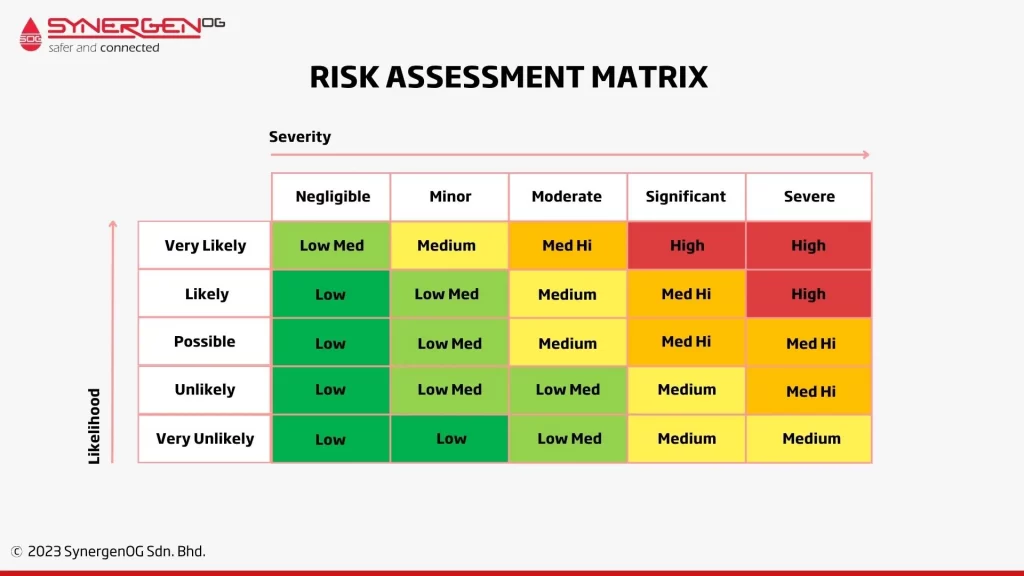

One commonly used tool for risk evaluation and prioritization is the Risk Assessment Matrix.

What is a Risk Assessment Matrix?

A Risk Assessment Matrix is a visual tool that combines the likelihood and impact scores to assess the overall risk level. It presents risks in a matrix format with likelihood on one axis and impact on the other axis. Risks are then plotted on the matrix, indicating their position based on their scores. The matrix typically includes different risk zones, such as low, medium, high, or critical risk, to classify risks based on their level of significance. The matrix helps in visualizing and prioritizing risks based on their combined scores. Risks falling in the high or critical risk zones require immediate attention and allocation of resources for mitigation efforts. Medium-risk risks may require further assessment or actions to bring them under control, while low-risk risks may be managed through routine controls and monitoring. |

#4. Risk Control and Mitigation

Risk control and mitigation play an important role in the oil and gas industry to prevent accidents, protect personnel and the environment, and ensure the continuity of operations. This principle focuses on implementing strategies to control and minimize the identified risks effectively.

Key Strategies for Risk Control and Mitigation in the Oil and Gas Industry

- Hierarchies of Control Measures: Hierarchies of control measures provide a systematic approach for selecting and implementing risk control strategies. These hierarchies are generally structured with the most effective controls at the top and less effective controls at the bottom.

The hierarchy includes measures such as, -

- Elimination

- Substitution

- Engineering controls

- Administrative controls

- Personal Protective Equipment (PPE)

- Modelling and Simulating Risk Control Scenarios: This strategy helps in evaluating the effectiveness of different control measures before their implementation. Computer-based simulation tools can simulate various operating conditions, assess potential risks, and test the performance of different control measures. This approach allows for a proactive evaluation of the effectiveness of control strategies, helps identify any gaps or limitations, and enhances decision-making by selecting the most optimal risk control measures.

#5. Risk Monitoring and Review

Continuous risk monitoring and review emphasize the importance of ongoing surveillance and evaluation to ensure that risks are addressed promptly and effectively.

Following are the key aspects of risk monitoring and review.

- Setting up a Risk Management System

Establishing a robust risk management system is essential for effective monitoring and review. This system should include clear roles and responsibilities for risk owners and stakeholders, standardized processes and procedures, and appropriate tools and technology to collect and analyze risk data.

- Leading and Lagging Indicators

Monitoring risks requires the use of both leading and lagging indicators. Leading indicators are proactive measures that provide insights into emerging risks or trends, allowing organisations to take preventive actions.

- Regular Review and Updates to Risk Assessments

The regular review process involves revisiting identified risks, assessing their current likelihood and potential impact, and incorporating any changes in the operating environment or regulatory requirements.

Regular reviews help identify emerging risks, evaluate the effectiveness of existing controls, and update risk management strategies accordingly. The frequency of review can vary depending on the organization, but it is generally recommended to conduct reviews at least annually or when significant changes occur within the industry or the organisation.

Conclusion

In conclusion, the oil and gas industry faces inherent risks that can have significant consequences for personnel, the environment, and operations. To effectively manage these risks in the industry, it is essential to follow the five principles of risk assessment.

[…] SynergenOG: Exploring the 5 Principles of Risk Assessment: In Detail […]