| Summary: It is necessary for oil and gas projects to incorporate a combination of qualitative and quantitative risk assessment methods. While both approaches aim to assess and analyze risks, they differ in terms of methodology, data collection, and analysis techniques. Exploring and comparing both methods in detail. |

Risk assessment helps to identify and evaluate potential risks that may impact the success or outcomes of a project. By assessing these risks, organizations can make informed decisions and take appropriate actions to mitigate or manage those risks effectively.

Qualitative and quantitative risk assessments are two commonly used methodologies in the field of risk management. While both approaches aim to assess and analyze risks, they differ in terms of methodology, data collection, and analysis techniques. Let’s have a detailed understanding of these methods here in this article.

Qualitative Vs Quantitative Risk Assessment

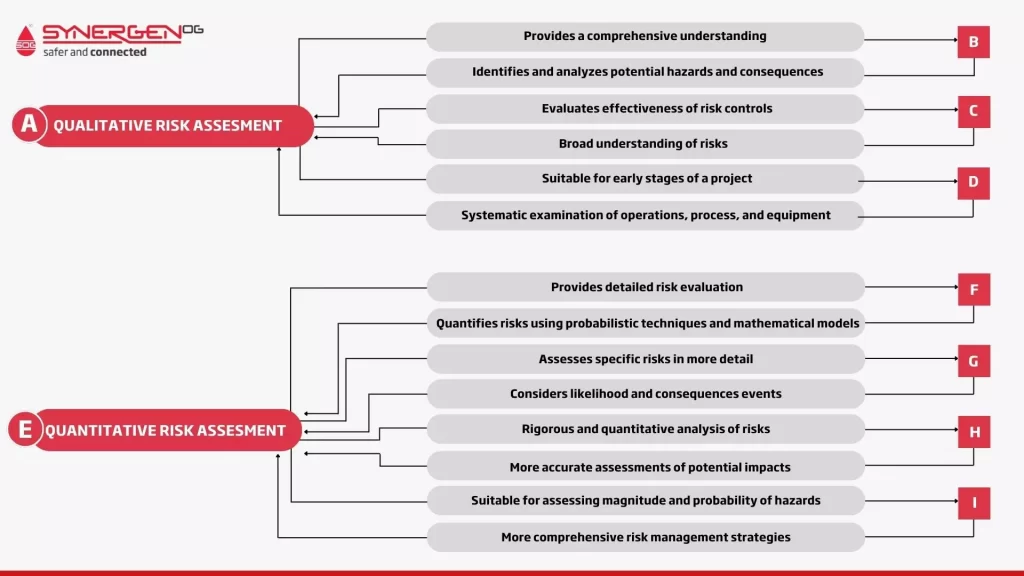

Qualitative risk assessment is a subjective approach that focuses on the likelihood and impact of identified risks. This method involves gathering information through expert opinions, historical data, brainstorming sessions, and risk matrices.

The identified risks are then evaluated based on predefined criteria such as low, medium, or high likelihood and impact. Qualitative risk assessment provides a qualitative understanding of risks, enabling organizations to prioritize and manage risks based on their potential consequences.

In contrast, quantitative risk assessment is a more objective and data-driven approach. It involves the use of statistical analysis, probabilistic models, historical data, simulations, and other mathematical techniques to quantify risks accurately. This method provides numerical values to represent the likelihood and impact of risks, allowing organizations to make more informed decisions based on quantitative data.

Qualitative Risk Analysis in Oil & Gas Industries

Qualitative risk analysis is a subjective approach to identifying, analyzing, and evaluating risks in the oil and gas industries. It is used when precise quantitative data is either unavailable or difficult to obtain. This approach relies on expert judgment, experience, and knowledge to evaluate risks and prioritize their significance.

When is it used?

Qualitative analysis is typically used in the oil and gas industries when quantitative data is difficult or expensive to obtain. It is also beneficial in situations where a quick assessment of risk is necessary, or when dealing with subjective risks that cannot be readily quantified. Qualitative risk analysis can be used as a stand-alone approach or as a supplement to quantitative risk analysis

Benefits of Qualitative Risk Analysis

Early Risk Identification: Allows organizations to identify potential risks early before they have a significant impact on the project or operations.

Expert input: Qualitative assessment relies heavily on expert opinions and judgment, enabling organizations to leverage their experience and knowledge to identify and assess risks.

Improved Risk Communication: Provides a common language and framework for discussing and communicating risks to diverse stakeholders, improving collaboration, and decision-making.

Improved risk prioritization: Enables organizations to prioritize risks based on their significance, establishing a clear hierarchy of risk management activities.

Quick and easy: Simple approach, requiring minimal data and resources to implement.

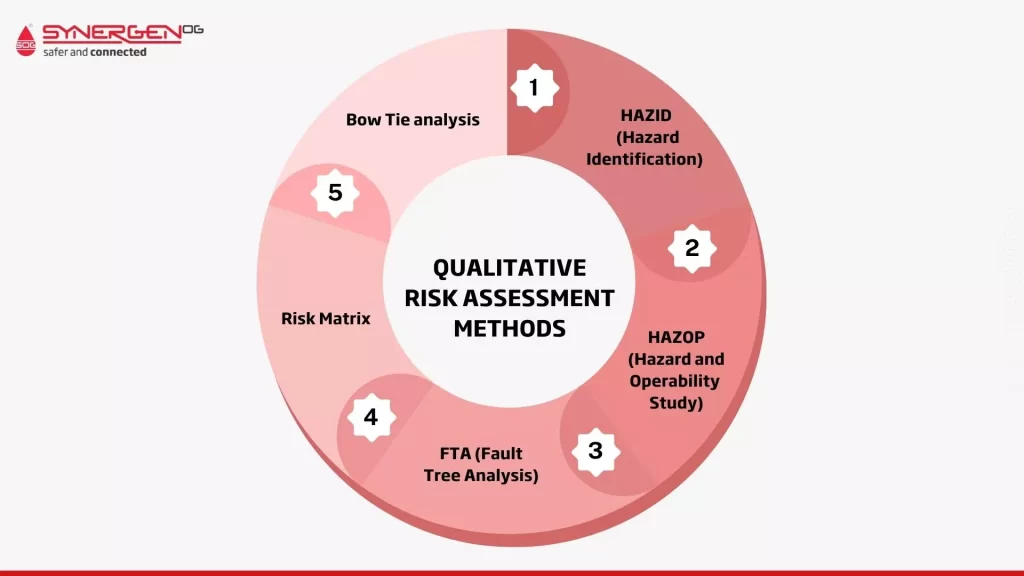

Qualitative Risk Assessment Methods in Oil & Gas Projects

- HAZID (Hazard Identification): This method involves identifying potential hazards associated with a specific process or project and prioritizing them based on risk level. It is usually conducted in the initial project planning phase.

- HAZOP (Hazard and Operability Study): HAZOP is a structured and systematic method for identifying potential hazards and operability issues in process design. It involves brainstorming sessions led by a facilitator, and recommendations are made to improve safety and operability in the process.

- FTA (Fault Tree Analysis): FTA is a graphical method used to analyze and understand the relationship between an undesired event (referred to as the top event) and the underlying causes of that event.

- Risk Matrix: This method involves assigning probability and severity scores to different hazards or scenarios, and plotting them on a matrix to prioritize the most critical risks. Once the risks are plotted, risk mitigation strategies can be developed.

- Bow Tie analysis: Bow Tie analysis is a graphical method used to visualize potential hazards and the measures put in place to control them. It is used to identify the critical control measures that are put in place to prevent a hazardous event from occurring and the potential consequences if the control measures fail.

Also Read: HAZID Vs. HAZOP

Quantitative Risk Analysis in Oil & Gas Industries

Oil and gas or petrochemical industries are known for their complex and high-risk projects. These industries face a wide range of risks, including operational, financial, safety, environmental, and geopolitical risks. These sectors benefit greatly from quantitative risk assessment, which allows for more accurate risk assessment and management.

When is it used?

Quantitative risk analysis is used in various scenarios within the oil & gas and petrochemical industries, including:

- Capital-intensive projects: When undertaking large-scale projects such as offshore drilling, refining complexes, or petrochemical plants, quantitative risk analysis helps assess financial risks, schedule overruns, and potential cost escalation.

- Safety and environmental risk assessment: Quantitative risk analysis aids in assessing risks related to safety hazards, such as fires, explosions, leaks, or spills. It also evaluates the environmental consequences of potential accidents or incidents.

- Project portfolio management: In situations where multiple projects are being considered, QRA allows for a comparative assessment of different projects to identify the ones with the highest potential returns and the lowest exposure to risks.

- Supply chain management: Quantitative risk analysis helps evaluate risks associated with supply chain disruptions, such as delays in equipment delivery, transportation bottlenecks, or geopolitical issues, enabling effective risk mitigation strategies.

- Asset integrity management: By quantitatively assessing risks to the integrity of assets such as pipelines, storage tanks, or offshore platforms, organizations can prioritize inspection and maintenance activities, reducing the likelihood of failures and accidents.

Benefits of Quantitative Risk Analysis in Oil & Gas Projects

Cost and schedule estimation: By quantifying risks, organizations can estimate potential cost overruns and schedule delays, enabling better financial planning and resource allocation.

Improved safety and environmental management: QRA allows organizations to identify and prioritize safety hazards and environmental risks, providing insights into resource allocation for preventive measures and emergency response planning.

Effective risk mitigation and contingency planning: By quantifying risks, organizations can prioritize and plan appropriate risk mitigation strategies. It enables them to develop contingency plans and allocate resources based on the severity of potential impacts.

Project selection and optimization: QRA aids decision-making by comparing the potential risks and returns of different projects, helping to select and optimize project portfolios.

Regulatory compliance: Quantitative risk analysis provides the necessary data and evidence to meet regulatory requirements related to safety, environmental impact, and risk management.

Processes Involved in a QRA

- Risk identification: Identify and document potential risks, considering internal and external factors that may impact the project or operations.

- Data collection: Gather relevant historical data, industry standards, expert opinions, and other sources of information necessary for analysis.

- Quantitative modelling: Develop mathematical models, simulations, and statistical techniques to quantify the likelihood and impact of risks.

- Data analysis: Analyze the collected data, applying statistical analysis and simulations to estimate the potential outcomes of different threats and vulnerabilities.

- Risk prioritization: Evaluate risks based on their quantitative values, considering financial impact, safety implications, environmental consequences, and strategic considerations.

- Risk mitigation planning: Determine strategies to mitigate or manage risks based on their quantitative analysis, such as preventive measures, safety engineering controls, emergency response plans, or business continuity strategies.

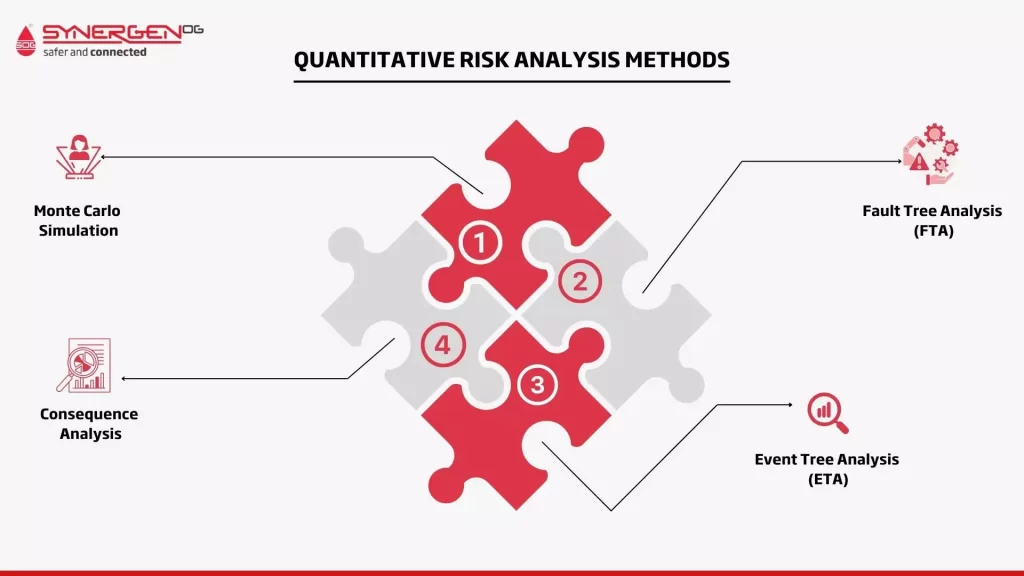

Common Methods for Quantitative Risk Analysis in Oil & Gas Facilities

QRA is a comprehensive method that combines multiple elements of risk analysis, including hazard identification, consequence analysis, and probability assessment. It uses mathematical models and data to estimate the likelihood and potential impacts of different hazard scenarios.

Some of the commonly used methods include:

Monte Carlo Simulation

Monte Carlo simulation is a technique that uses random sampling to model and analyze the uncertainty and variability in a system. It is often used in conjunction with QRA to assess the impact of multiple variables and uncertainties on the overall risk.

Fault Tree Analysis (FTA)

FTA is used in both qualitative and quantitative risk assessment. In quantitative risk assessment, FTA can be used to calculate the probability of the top event (undesired event) based on the probabilities of the underlying causes.

Event Tree Analysis (ETA)

ETA is a graphical method used to model the sequence of events following an initiating event and estimate the probability and consequences of different outcomes. It is often used in conjunction with FTA to assess the potential consequences of specific hazard scenarios.

Consequence Analysis

Consequence analysis involves estimating the potential consequences of a hazardous event, such as fire, explosion, or release of toxic substances. It may include assessing the impact on personnel, equipment, infrastructure, and the environment.

Also Read: Process Hazard Analysis Methods

Examples of When to Use Quantitative Risk Analysis in Oil & Gas

1. Pipeline Integrity: Quantifying Structural Risks

– Probability Analysis for Leak Incidents

In the assessment of pipeline integrity, a crucial aspect is conducting a comprehensive probability analysis for potential leak incidents. This involves evaluating the factors that contribute to the likelihood of a leak occurring. Key elements in this analysis include:

- Material Degradation Assessment: Examining the materials used in pipeline construction and assessing their susceptibility to corrosion or wear over time.

- Operational Conditions: Analyzing the impact of operational parameters such as pressure, temperature, and flow rates on the likelihood of leaks.

- Environmental Factors: Considering external elements like soil corrosivity, seismic activity, and weather conditions that may affect pipeline integrity.

- Historical Incident Data: Incorporating data from past incidents to identify patterns and trends, contributing to a more accurate probability assessment.

– Consequence Assessment in Spill Scenarios

Once the probability of a leak is determined, the next step involves assessing the potential consequences of spill scenarios. This includes

- Volume Estimation: Quantifying the potential volume of the spilled material based on factors such as pipeline diameter, pressure, and the nature of the transported substance.

- Spill Pathway Analysis: Identifying the likely pathways the spilled material would take, considering factors like terrain, water bodies, and population density.

- Environmental Impact Assessment: Evaluating the potential impact on ecosystems, water sources, and wildlife in the event of a spill.

- Human Health and Safety Implications: Assessing the potential effects on nearby communities, considering factors like toxicity, flammability, and exposure pathways.

2. Process Safety Management: Applying Quantitative Methods

Process safety management within oil and gas facilities relies heavily on quantitative risk analysis. This involves:

Hazard Identification: Utilizing methods such as Hazard and Operability Studies (HAZOP) to identify potential hazards in the operation.

Frequency Analysis: Quantifying the frequency of identified hazards, considering factors like equipment failure rates, human error probabilities, and process deviations.

Consequence Analysis: Assessing the potential consequences of identified hazards, including the impact on personnel, equipment, and the surrounding environment.

Risk Quantification: Combining the results of frequency and consequence analyses to quantify the overall risk associated with specific processes or operations.

Mitigation Strategies: Developing and implementing risk mitigation strategies based on quantitative analysis, prioritizing actions to reduce the most significant risks.

Comparative Analysis of Qualitative vs Quantitative Assessments

Qualitative and quantitative risk assessment methods are not mutually exclusive but they can complement each other in the overall risk management process.

Qualitative methods are often used in the early stages of risk assessment to quickly identify and prioritize major risks. Quantitative methods are then employed to provide a more detailed and accurate analysis of risks for informed decision-making.

Here is a list of the major advantages and limitations of both methods.

| Advantages | Qualitative Risk Assessment | Quantitative Risk Assessment |

| – Simplicity and ease of use | – Provides a more accurate and detailed understanding of risks | |

| – Quick identification of major risks | – Enables informed decision-making based on numerical results | |

| – Useful for initial screening and decision-making | – Incorporates complex mathematical models and statistical analysis | |

|

– Can be applied in the absence of detailed data

|

– Can consider multiple variables and uncertainties | |

| Limitations | – Subjective and relies on expert judgment | – Requires extensive data collection and analysis |

| – Lack of numerical data and precision | – Can be time-consuming and resource-intensive | |

| – Limited in assessing likelihoods and consequences | – Complex models may be difficult to understand and communicate | |

| – Limited in distinguishing between risks of similar severity | – Assumptions and uncertainties can affect the accuracy of results |

Addressing Common Misconceptions on both methods

Risk assessment is a complex process that involves both qualitative and quantitative methods. However, misconceptions about the two methods still exist. Here are two common myths surrounding risk assessment:

A. Myth: Quantitative Analysis is Always Superior

One of the most common misconceptions about risk assessment is that quantitative methods are always superior to qualitative methods. While quantitative methods provide a more detailed and accurate analysis of risks in many cases, they are not always the best approach.

Quantitative methods require extensive data collection and analysis, and they often incorporate complex mathematical models and statistical analysis. This can make them time-consuming, resource-intensive, and difficult to understand. In some cases, the data may be lacking or unreliable, making a quantitative approach less effective.

On the other hand, qualitative methods are generally quicker, simpler, and easier to understand. They are useful for initial screening and decision-making, especially when data is lacking or when risks need to be quickly identified and prioritized.

In summary, both qualitative and quantitative methods have their advantages and disadvantages, and the selection of the approach depends on the specific objectives and requirements of the risk assessment.

B. Myth: Qualitative Methods Lack Precision

Another common myth is that qualitative methods lack precision. While it is true that qualitative methods may not provide numerical results, precision is not always necessary or appropriate in risk assessment.

Qualitative methods are useful for screening and initial assessments, where the focus is on identifying and prioritizing risks. This involves expert judgment and subjective assessment, which is not always quantifiable. However, this does not mean that qualitative methods are imprecise or unreliable.

Concluding that qualitative methods can provide valuable insights into risk assessment, especially in the early stages where identifying and prioritizing risks is critical. Qualitative methods do not lack precision and can complement quantitative methods in the overall risk management process.

|

Conclusion

In conclusion, when it comes to risk assessment in oil and gas projects, both qualitative and quantitative methods are important in different project phases.

It is necessary for oil and gas projects to incorporate a combination of qualitative and quantitative risk assessment methods. By utilizing qualitative methods to identify and understand potential hazards and quantitative methods to assess the magnitude and probability of those hazards, organizations can effectively manage and mitigate risks in their projects.

[…] Qualitative Risk Assessment: This approach assesses risks based on subjective judgment and expert opinions without numerical data. It categorizes risks as low, medium, or high based on their likelihood and impact, allowing organizations to prioritize risks for further action 12. […]

[…] Read More- https://synergenog.com/qualitative-vs-quantitative-risk-assessment/ […]